The Great AI Illusion: An Investigation into an Economic Engine Running on Empty.

The industrial revolution had its oil and steel barons; the AI revolution has its barons of silicon and the cloud.

The announcement has the brilliance of a moment that defines an era. Nvidia, the semiconductor titan, is planning a massive $100 billion investment in OpenAI, the leader in generative artificial intelligence. In return, OpenAI plans to acquire an equivalent sum—$100 billion—of four to five million Nvidia chips. A ten-figure exchange of favors that, at first glance, symbolizes the staggering acceleration of a technological revolution.

However, behind the facade of this explosive growth lies a more complex mechanism —a financial ballet that is both fascinating and deeply unsettling. We are not witnessing a simple transaction, but the most spectacular manifestation of an ecosystem running in a closed loop, an economic engine that appears to be fueling itself. The AI value chain, dominated by a quartet of Nvidia, OpenAI, Microsoft, and the hosting provider CoreWeave, looks more and more like a snake biting its own tail.

Each one feeds the other in a dance of reciprocal dependencies that inflates valuations and gives the illusion of inexhaustible organic demand. Nvidia injects capital into its largest customers, who use that money to buy its own products. Microsoft, rather than providing cash, offers cloud credits that chain startups to its Azure ecosystem. OpenAI, the showcase of this revolution, transforms investments into massive hardware expenditures. And players like CoreWeave capture surplus demand by offering computing power at bargain-bin prices, often financed by the same venture capital flows.

This dizzying circularity raises a fundamental question: is this growth real, or are we witnessing the construction of a spectacular bubble, a “rational bubble” founded on genuine technology but whose economy rests on artificial foundations? The parallel with the excesses of the dot-com bubble of the 2000s is more than striking; it is deafening.

AI Is Killing the Web, and We're Looking Away: Chronicle of a Death Foretold.

Imagine the scene. Tomorrow morning, you wake up, grab your coffee, and open your laptop to check your favorite news sites, read a few blog posts, or browse a niche forum. But instead of the familiar content, you find only blank pages, 404 error messages, and the deafening silence of a digital graveyard

A Sense of Déjà Vu: The Forgotten Lesson of the Dot-Com Bubble

To understand the current dynamic, a look back is necessary. In the late 1990s, enthusiasm for the internet was boundless. Billions of venture capital dollars flooded “dot-com” startups, most of which had no viable business model. Their main growth strategy was to spend massively on advertising to acquire “eyeballs,” the reigning metric of the era.

Where did this money go? Largely into the coffers of web portal giants like Yahoo! or AOL. A startup would raise $100 million and spend $80 million of it on banner ads on Yahoo!’s homepage. Yahoo!’s revenue would skyrocket, justifying its stratospheric valuation, which in turn attracted more investors, and the cycle would repeat. The money just circulated between the pockets of the same players, creating a fictitious economy disconnected from any real value creation.

The phenomenon was even more flagrant on the side of equipment manufacturers. Companies like Cisco and Nortel, which built the physical infrastructure of the internet, established “vendor financing” systems. They didn’t wait for their customers, often fragile telecom startups, to have the means to buy their routers and switches. They lent them the money for the purchase directly. On paper, Cisco and Nortel’s revenues soared. In reality, they were creating debt that would never be repaid when their customers went bankrupt.

Today, history seems to be repeating itself, but with new players and a new resource. Computing power—or compute—has replaced bandwidth and banner ads as the bubble’s currency. Cloud credits from Microsoft Azure or Google Cloud are the new “vendor financing.” Nvidia’s investment in OpenAI is nothing more than a sophisticated version of this mechanism: “I’ll give you money so you can buy from me.” The goal is the same: to secure demand, post outrageous growth, and convince the market that the party is just getting started.

The Elephant in the Room: Where Are the End Customers?

All of this financial engineering rests on a single assumption: generative AI will become ubiquitous, very quickly, and will be massively monetizable. This is the big bet. For now, demand comes mainly from the ecosystem itself. Startups raise funds to train their models, and big tech companies invest billions to avoid being left behind. But the final demand—the one that comes from real customers paying for services that solve concrete problems and generate profits—remains largely to be proven on a scale that would justify such valuations.

The costs associated with AI are astronomical and recurring. Training a state-of-the-art model costs hundreds of millions of dollars. Inference, which is the day-to-day use of the model, consumes a considerable amount of energy and resources. These infrastructure costs weigh heavily on potential profitability. For every dollar of revenue generated by an AI service, how much must be spent on Nvidia chips and Azure servers? The ratio, for now, is far from favorable.

Many current applications struggle to move beyond the stage of a technological gadget or a marginal productivity tool. A coding assistant, an image generator, or an improved chatbot are certainly useful, but do they represent a revolution justifying trillions of dollars in investment? The risk is that for many companies, generative AI is a feature to be integrated into existing products rather than a product in itself. If that’s the case, the value captured will be much less than anticipated.

The New Barons of the 21st Century

What makes this period unique is the extreme concentration of power. The industrial revolution had its oil and steel barons; the AI revolution has its barons of silicon and the cloud.

Nvidia has become the Standard Oil of the 21st century. The company doesn’t just sell chips; it controls the fundamental resource upon which the entire industry is built. Just as oil was essential to the 20th-century economy, GPUs are the fuel of the intelligence economy. This de facto monopoly position gives Nvidia unprecedented pricing power and geopolitical influence, as evidenced by U.S. export restrictions aimed at curbing China’s ambitions.

Microsoft, for its part, has made a strategic masterstroke. By allying with OpenAI, the company has not only revitalized its image and put immense pressure on its rival Google, but it has also found the perfect justification for its massive investments in the Azure cloud. Every success for OpenAI is a victory for Azure. Microsoft has locked down the star of AI, ensuring that the majority of the value created remains within its domain.

This oligopoly creates nearly insurmountable barriers to entry. Without access to tens of thousands of GPUs and billions of dollars in capital, it is currently impossible to compete at the frontier of innovation.

The Outcome: Purge, Normalization, or Plateau?

This circular system cannot last forever. Sooner or later, it will have to confront economic reality. Three scenarios for the future are taking shape.

1. The Dream Becomes Reality: Real demand explodes. Generative AI becomes deeply integrated into all sectors of the economy, creating massive productivity gains and new markets. Businesses and consumers adopt these technologies on a large scale and are willing to pay for them. In this scenario, current valuations are justified. Nvidia truly becomes the “oil of the 21st century,” and Microsoft and the other cloud giants reign over a new technological era.

2. The Bubble Bursts: Demand is slow to materialize. The costs prove too high relative to the revenue generated. Investors lose patience, and the flow of capital dries up. A brutal correction ensues. Startups go bankrupt, projects are abandoned, and billions of dollars in value are destroyed. As after the dot-com bust, this violent purge would clean house and leave the field open for new, more agile players with more solid business models. A “Google” of the AI era, perhaps born from open source or an unexpected breakthrough innovation, could emerge from the rubble.

3. The Long Plateau: An in-between scenario. Adoption is real but slower and more limited than expected. AI finds profitable niches but fails to transform the entire economy. Profitability remains under constant pressure, and the race for cost optimization replaces the race for performance. The sector would experience a long period of consolidation and normalization, far from the current frenzy.

We are in the midst of a rational bubble: the technology is revolutionary, but the valuations and the speed of execution far exceed the natural pace of adoption and monetization. The question is not if a readjustment will occur, but how. Will we witness a spectacular crash or a slow and painful descent back to earth?

One thing is certain: the AI landscape of tomorrow will not resemble that of today. The real winners may not even be on the stage yet. What a time to be alive!

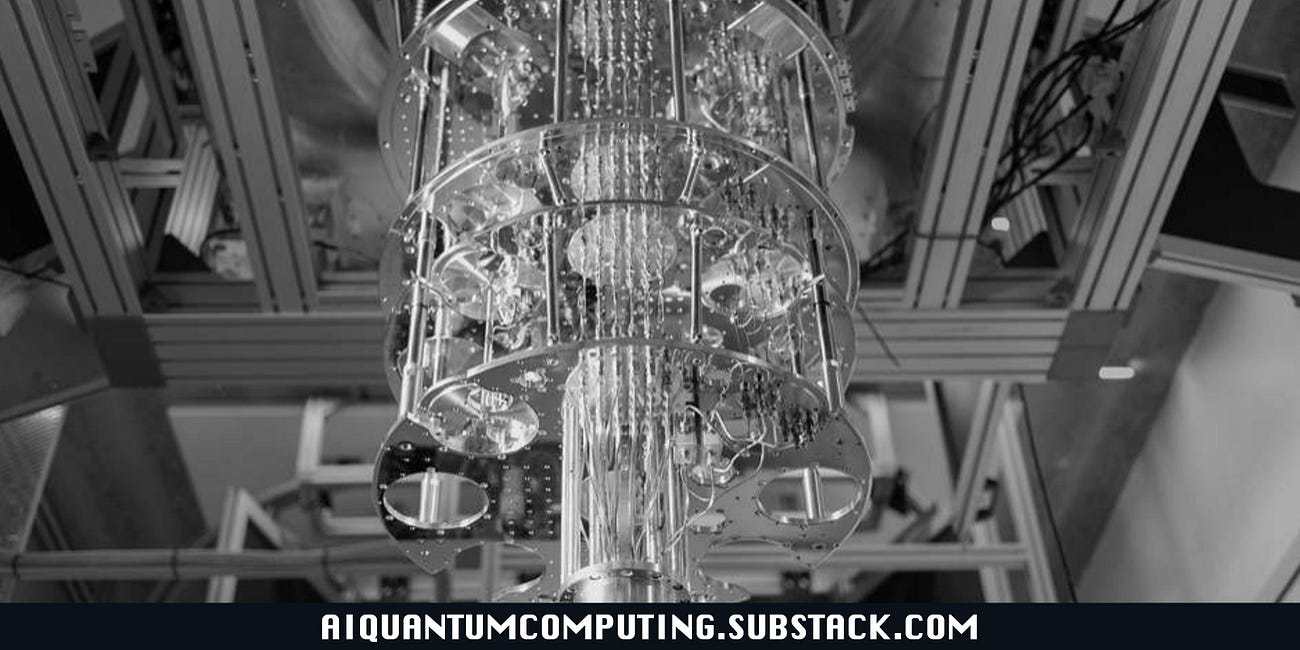

The Noise Paradox: How IBM Scientists Flipped the Script on Quantum Errors.

In the nascent and exhilarating world of quantum computing, one axiom has long been held as gospel: noise is the enemy. For years, physicists and engineers have waged a relentless war against it. Noise—the incessant, random interference from the environment that corrupts the fragile quantum states of qubits—has been seen as the ultimate barrier separati…

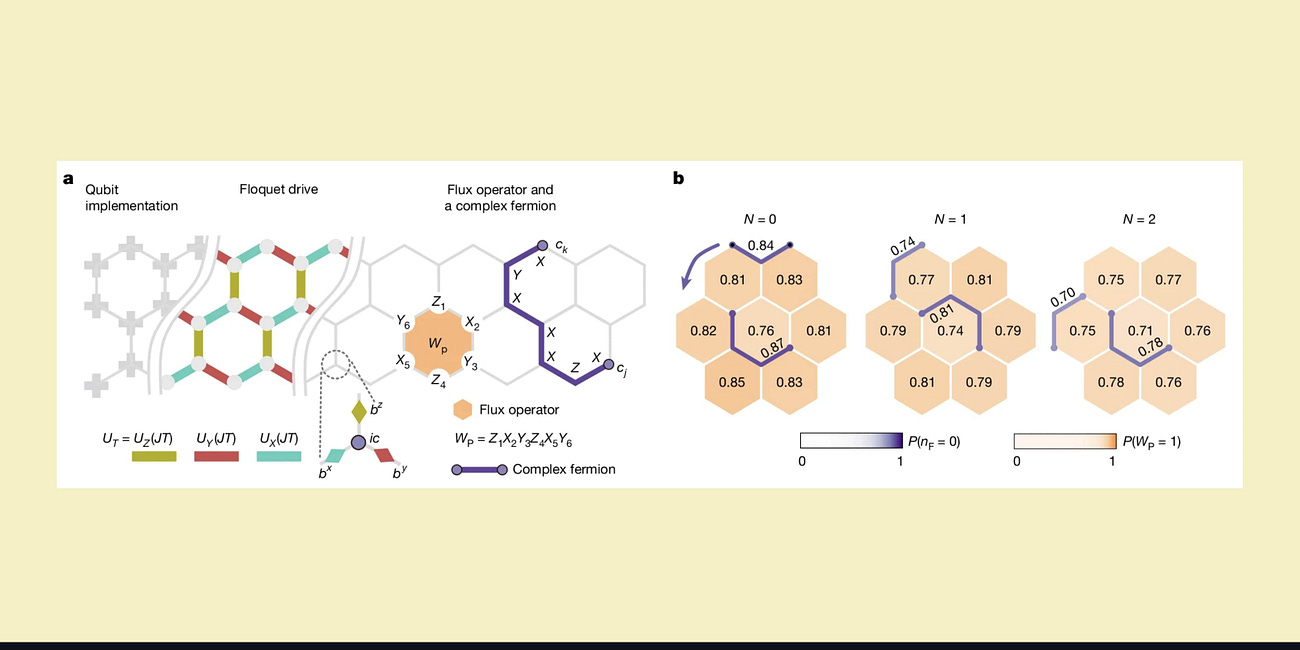

Beyond Reach: How a Quantum Processor Unlocked a "Forbidden" Phase of Matter.

In the strange and counterintuitive world of quantum mechanics, there are phenomena so complex, so deeply entangled, that they lie beyond the horizon of our most powerful supercomputers. These are not merely difficult calculations; they represent entire realms of physics that, until now, have existed only in the abstract language of theoretical equation…

5 "Quantum-Proof" Skills to Start Building Today.

Marseille, France – It’s a bright, breezy Saturday morning, September 6th, 2025. From a balcony in the Le Panier neighborhood, the view is a timeline in itself. Below, the ancient Vieux-Port bustles, a harbor that has welcomed Greek traders, Roman galleys, and medieval merchant ships.