The Dawn of the Autonomous Economy: Google and Coinbase Unleash a Revolution with AI-Powered Payments.

By standardizing how these intelligences exchange value, Google is not just meeting a need; it is creating it, structuring it, and positioning itself as its indispensable architect.

A tremor is running through the tech sphere, the kind of shake-up that signals the tectonic plates of innovation are shifting. This is no longer a mere rumor or a distant projection from a science-fiction future. It is a concrete reality, announced by one of the world's greatest digital architects: Google. In collaboration with cryptocurrency giant Coinbase and with the endorsement of the Ethereum Foundation, Google has just unveiled a payment protocol that could very well redefine the very foundations of the digital economy. Its name is not yet on everyone’s lips, but its ambition is universal: to allow artificial intelligences to pay each other, instantly, securely, and globally, thanks to the power of stablecoins.

This announcement is not an isolated event. It is part of a meticulously orchestrated strategy by the Mountain View titan. The launch of its Google Cloud Universal Ledger solution at the end of August had already laid the first bricks, signaling a clear intent to establish a foothold at the crossroads of cloud services and distributed ledger technologies. Today, with this AI payment protocol, Google is no longer just building bridges; it is designing the highways for a new economy—an economy where autonomous agents will become economic actors in their own right.

The equation is as simple as it is powerful: Google’s massive strength in cloud and AI, combined with Coinbase’s crypto-native expertise and infrastructure, creates a transaction standard for the intelligences of tomorrow. We are witnessing the birth of the financial infrastructure for the age of artificial intelligence.

AI Is Killing the Web, and We're Looking Away: Chronicle of a Death Foretold.

Imagine the scene. Tomorrow morning, you wake up, grab your coffee, and open your laptop to check your favorite news sites, read a few blog posts, or browse a niche forum. But instead of the familiar content, you find only blank pages, 404 error messages, and the deafening silence of a digital graveyard

A Strategic Alliance for a Monumental Challenge

To understand the scope of this initiative, one must analyze its players. Google, through its Google Cloud division, is at the heart of the AI revolution. Millions of developers, companies, and startups use its infrastructure to train and deploy increasingly sophisticated AI models. The search giant, therefore, has a front-row seat to the emerging needs of this ecosystem. One of these needs is glaringly obvious: payment friction.

In a world where AI can analyze data, make decisions, and execute actions in a fraction of a second, traditional payment systems—with their processing delays, business hours, and transaction fees—are an anachronism. They are the horse and cart on a Formula 1 highway.

This is where Coinbase comes in. Far from being a simple partner, the exchange platform is a co-architect of this vision. By developing its own payment scheme based on AI and cryptocurrencies, Coinbase brings crucial expertise to the table. Erik Reppel, the company’s head of engineering, perfectly summarizes the challenge: “We are all working to understand how to get AI agents to be able to transmit value between each other.” This simple sentence conceals immense complexity, a challenge that neither Google nor Coinbase could tackle alone.

The involvement of the Ethereum Foundation adds a layer of credibility and openness. By helping to refine the protocol, it ensures that the standards being developed are not locked into a proprietary ecosystem but are based on the open and interoperable principles dear to the blockchain philosophy.

At the Heart of the Protocol: The Fuel for Intelligent Agents

But what does this protocol actually do? It creates a common language, a communication standard for value. Let’s imagine the near future, a future that Google is actively anticipating. Your personal AI assistant, after analyzing your preferences and schedule, decides it's time to book your vacation. It communicates with an airline’s AI to find the best flight, then with a hotel’s AI for the reservation. Once the options are validated, it needs to pay. This is where the protocol comes into play.

It allows your AI “agent” to pay the airline’s agent and the hotel’s agent securely, instantly, and verifiably. The head of Web3 at Google Cloud makes it clear: the protocol was designed to incorporate both “the capabilities of existing payment networks and upcoming capabilities such as stablecoins.”

This dual approach is the key to its potential for adoption:

The Traditional Rails: By including credit and debit cards, Google ensures essential backward compatibility. Decades of habits and financial infrastructure cannot be replaced overnight. This aspect is reassuring and facilitates integration for existing businesses.

The Rails of the Future (Stablecoins): This is where the real revolution lies. Stablecoins, cryptocurrencies pegged to a fiat currency like the dollar (e.g., USDC, USDT) or the euro, offer ideal properties for a machine economy:

Programmability: Payments can be embedded in smart contracts, triggering value transfers only when certain conditions are met.

Instant Settlement: Transactions are settled in seconds or minutes, 24/7, without depending on banking hours.

Low Costs: On modern blockchain networks, transaction fees are minimal, enabling micropayments that are impossible to execute profitably with traditional systems.

Global Nature: A stablecoin is a global digital asset, ignoring borders and the complexities of international wire transfers.

For an AI that thinks in terms of logic, efficiency, and constant availability, stablecoins are not an option; they are the obvious solution.

Use Cases That Redefine Commerce

The travel assistant example is just the tip of the iceberg. This protocol opens the door to a myriad of applications that will transform entire sectors of our economy.

Autonomous Decentralized Finance (DeFi): Imagine virtual financial advisors that not only recommend investment strategies but execute them for you. Your AI agent could pay for real-time analysis data streams from another agent, then interact directly with decentralized lending or trading protocols to place orders, all autonomously, while adhering to the risk parameters you have set.

The Transactional Internet of Things (IoT): Your self-driving electric car arrives at a charging station. It negotiates the rate with the station’s AI based on the time of day and network demand, then automatically pays for the exact amount of energy consumed via the protocol. Your smart fridge detects you’re low on milk, orders from the cheapest and fastest delivery service, and pays for it directly, without any human intervention.

Digital Content Creators: An AI image generator might need to use a specific style model developed by another AI. Through the protocol, it could pay a micropayment for each use, creating an entirely new and automated intellectual property economy between machines.

The Challenges of a New World: Trust, Security, and Regulation

This future, as promising as it is, is not without its challenges. The creation of an economy where non-human agents move billions of dollars raises fundamental questions.

The first is security. How can we ensure that an AI agent isn’t hacked or doesn’t develop unforeseen behavior that leads it to drain its owner’s bank account? Google insists that the protocol guarantees transactions are “safe and secure” and “consistent with the intentions of human users.” The robustness of this claim will be the key to trust and adoption.

The second is regulation. Lawmakers worldwide are already struggling to regulate the cryptocurrency sector. The arrival of autonomous economic agents represents a legal and fiscal puzzle of a completely different magnitude. Who is liable in case of an error? How do you tax transactions between two machines?

Finally, there is the question of centralization. Although the protocol is announced as open-source, the central role of Google Cloud and Coinbase could create new points of control in an economy that, through the blockchain philosophy, was intended to be decentralized. The balance between the efficiency offered by these giants and the principles of openness will be a crucial issue to watch.

A Decisive Turning Point

The announcement from Google and its partners is much more than a simple technological innovation. It is a foundational act. It is the recognition by the biggest players in tech that the next wave of the internet will not just connect information or people, but will connect intelligence capable of acting and transacting.

By standardizing how these intelligences exchange value, Google is not just meeting a need; it is creating it, structuring it, and positioning itself as its indispensable architect. The long-anticipated megatrend of a machine-to-machine (M2M) economy has just found its catalyst. Today, this vision is taking a very real turn, and its financial rails are being laid, block by block, transaction by transaction, in Google's cloud, with stablecoins as the fuel. The future of payments is not just digital; it is autonomous and intelligent.

Bitcoin and the Unseen War for Your Future: Jeff Booth Exposes the AI-Fueled Collision of Two Worlds.

You’re standing at a fork in the road of history. Which path you choose will determine not only your own future, but the future of the world.

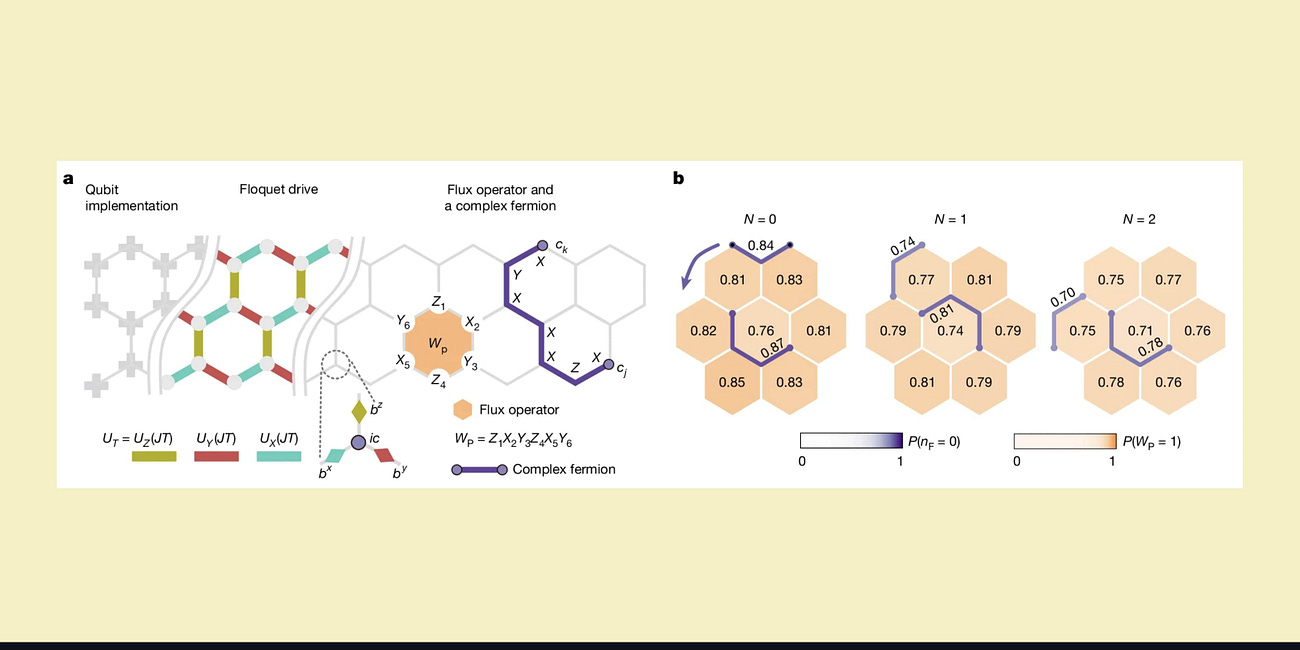

Beyond Reach: How a Quantum Processor Unlocked a "Forbidden" Phase of Matter.

In the strange and counterintuitive world of quantum mechanics, there are phenomena so complex, so deeply entangled, that they lie beyond the horizon of our most powerful supercomputers. These are not merely difficult calculations; they represent entire realms of physics that, until now, have existed only in the abstract language of theoretical equation…