Overheating, Speculation, Revolution: Is AI the Inevitable Bubble of the 21st Century?

Is it really different this time?

$4.68 trillion. That is the valuation of Nvidia, the chipmaker that has become the cornerstone of the artificial intelligence revolution.

$500 billion. That is the valuation of OpenAI, an unlisted, unprofitable startup.

Meanwhile, Amazon, Microsoft, Alphabet, and Apple, the other tech titans, alone account for nearly 30% of the S&P 500’s total capitalization—a historic level of concentration.

The world is fixated on AI, and the numbers are dizzying. A wind of euphoria, fueled by colossal investments and widespread enthusiasm, is blowing through the financial markets. But this intoxicating breeze carries a familiar scent, an unsettling echo: that of the dot-com bubble of 2000.

A growing number of voices, from the IMF to the Bank of England, are rising to warn against overheating. The signs are accumulating: valuations disconnected from profits, massive investments with uncertain returns, and a speculative frenzy reminiscent of the darkest hours of the dot-com bubble.

In this climate of exuberance, a fundamental question is resurfacing, as sharp as it was in 1999: Is artificial intelligence the engine of a new economic era, an industrial revolution comparable to the advent of the internet? Or is it merely the fuel for a gigantic speculative bubble, inflated by easy money and overblown promises, ready to burst and wipe trillions of dollars off the map?

The Quantum Dragon Roars: China Launches Commercial Superconducting Computer, Shaking the Foundations of Global Tech.

A new era in computing has officially dawned, not with a quiet hum in a secluded laboratory, but with the flick of a digital switch that reverberates across the globe. China has connected its most powerful superconducting quantum computer to the cloud, making its unprecedented computational power available for commercial use.

The Anatomy of a Fever: Giants Valued at a Loss

The irony of the situation is not lost on anyone, especially not the main player involved. At the end of August, Sam Altman, the visionary founder of OpenAI, creator of ChatGPT, tempered the prevailing fervor himself. “Are we in a phase where investors as a whole are over-excited about artificial intelligence? I think so,” he conceded, promising a “more human” and less speculative AI.

A few weeks later, his own company, still unprofitable and unlisted on the stock exchange, was valued at $500 billion. This figure, unprecedented for a company with this profile, is the most spectacular symptom of an underlying trend. The market is no longer paying for current profits; it is paying for a hypothetical future, a potential for global domination.

This case is not isolated. The market is now dominated by a handful of “giants.” The weight of the “Magnificent Seven” (Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Tesla) has reached a level of concentration never seen before. Nearly one-third of the value of the main US stock index rests on their shoulders alone.

Nvidia is the epicenter of this earthquake. With a market capitalization of $4.68 trillion, its value has exploded, not because it produces end-user AI services, but because it manufactures the “picks and shovels” of this new gold rush: the GPU (Graphics Processing Units) chips essential for training large language models. The demand is so strong that Nvidia has become one of the most profitable companies in the world. But its current valuation assumes perfect, uninterrupted growth for years to come—a scenario that economic history rarely tolerates.

The Ghosts of 2000 Re-emerge

This concentration and these stratospheric valuations are sending shivers down the spines of financial orthodoxy’s guardians. The International Monetary Fund (IMF), the Bank of England, and several major investment banks are publicly drawing a direct parallel with the irrational exuberance of the late 1990s.

Objective market indicators, when analyzed coldly, prove their concerns valid. First, the Price-to-Earnings (P/E) ratio of the S&P 500. This indicator measures how much investors are willing to pay for each dollar of earnings. Today, it stands at 23. This level is dangerously close to the historic peak of 25, reached just before the dot-com bubble burst in March 2000. This means that stocks are, on average, as expensive as they were at the peak of the previous speculative mania.

Second, and perhaps the most alarming figure, is the ratio of the total value of US corporate equities to the country’s nominal GDP. This indicator, sometimes nicknamed the “Buffett indicator,” measures the market’s valuation relative to the size of the real economy. In the second quarter of this year, it reached 363%. This is a record. To put this figure in perspective, at the peak of the 2000 bubble, this ratio was “only” 212%. The disconnect between the financial sphere and the productive economy has never been greater.

Faced with this picture, the IMF has issued a clear warning: a “disappointment generated by AI results” could trigger a brutal correction. If the promises of massive productivity gains are slow to materialize on companies’ balance sheets, confidence will evaporate, and the re-evaluation of tech stocks will be sudden and violent.

The Great Disconnect: $1.5 Trillion in Search of Profitability

At the heart of this concern lies the growing disconnect between stock market valuation and real profitability. While AI promises a revolution, its concrete effects on profits remain, for now, largely speculative.

The money, however, is flowing freely. According to the research firm Gartner, global investments in AI-dedicated infrastructure are expected to reach the astronomical figure of $1.5 trillion this year. This money is primarily directed towards building data centers and purchasing high-end computer hardware in the United States.

This volume of investment is furiously reminiscent of the 2000s boom in fiber optics and telecoms. Back then, companies like Global Crossing or WorldCom invested billions to lay undersea cables, anticipating an exponential explosion in internet traffic. The explosion did happen, but much later. The companies themselves went bankrupt, unable to make their colossal short-term investments profitable.

We may be witnessing the same phenomenon. The AI infrastructure is being built at a breakneck pace, but profitability is not keeping up. Alexandre Baradez, an analyst at IG, offers a stark diagnosis: “80% of companies in the AI field are not profitable.” They survive on successive funding rounds, in a climate of euphoria where investors finance promises rather than results. How long can this model hold?

A Closed-Loop Ecosystem and Retail Fever

Beyond valuations, it is the internal dynamics of the sector that are fueling mistrust. A phenomenon of “circularity” in deals, even “inbreeding,” has taken hold, recalling the most opaque speculative mechanics of the dot-com bubble.

Take a concrete example: in the span of one month, OpenAI struck a $100 billion deal with Nvidia (to buy its chips), then announced the purchase of several billion dollars’ worth of equipment from AMD, before considering a partnership with Broadcom.

The Great AI Illusion: An Investigation into an Economic Engine Running on Empty.

The announcement has the brilliance of a moment that defines an era. Nvidia, the semiconductor titan, is planning a massive $100 billion investment in OpenAI, the leader in generative artificial intelligence. In return, OpenAI plans to acquire an equivalent sum—$100 billion—of four to five million Nvidia chips.

Let’s analyze this loop: Investors (like Microsoft) inject billions into OpenAI. OpenAI uses this money to buy chips from Nvidia. Nvidia’s revenues explode, which drives up its stock market valuation. This rise validates the euphoria around AI, which allows OpenAI to raise even more money. It’s a closed circuit. The money circulates among the same players, inflating the revenues of some and the valuations of others, without new and external economic value (from end customers paying for a profitable service) necessarily being created in proportion.

During the dot-com bubble, startups used money raised on the stock market to buy advertising space on other dot-com sites, which in turn used that money to... buy banner ads. The bubble fed on itself before it imploded. The resemblance is troubling.

Added to this is a final, classic ingredient of late-cycle markets: the massive involvement of retail investors. Today, more than 35% of US stocks are held by individual investors. This is a much higher figure than that observed in 2000. Driven by “FOMO” (Fear Of Missing Out), millions of amateur investors are rushing into AI stocks, hoping for quick riches, often at the very moment when valuations are already at their peak.

Counter-Argument: “This Time, It’s Different”

The analogy with 2000, while tempting, has its limits. And therein lies the full complexity of the debate. The most dangerous mantra in finance is “this time, it’s different.” Yet, some powerful arguments suggest that, fundamentally, the situation is not comparable.

The key difference lies in the companies dominating the market. In 2000, the bubble’s leaders were precarious startups like Pets.com or Webvan—companies with no business models, no revenues, and certainly no profits. They sold only “eyeballs” (the number of visitors to their site) and promises.

Today, the leaders are Microsoft, Alphabet (Google), Amazon, and Nvidia. These companies are not houses of cards. They are the most profitable and well-capitalized entities in the history of capitalism. They possess “moats”: diversified and dominant business models (Windows and Azure for Microsoft, online advertising for Google, e-commerce and AWS for Amazon).

AI is not their only bet. It is a force multiplier for their existing businesses. Microsoft integrates Copilot (an AI) into its Office suite, making it indispensable and justifying price increases. Google infuses AI into its search engine to maintain its dominance. Amazon uses it to optimize its logistics and its cloud.

As for Nvidia, it isn’t selling a promise. It is selling a physical, tangible product for which demand far outstrips supply, and on which it makes colossal profit margins. The AI revolution needs its chips, and for now, no one does it better.

Moreover, the technology itself is real. Unlike many vague concepts from the year 2000, generative AI is already a tool used by hundreds of millions of people. ChatGPT writes emails, AIs generate images, and copilots help write code. The productivity revolution, while perhaps overestimated in the short term, has already begun.

Final Thoughts: Between Inevitable Revolution and Brutal Correction

We are therefore caught between two certainties. On the one hand, AI is a fundamental technological revolution, likely as important as the invention of the internet or electricity. On the other hand, financial markets are in the grip of a speculative fever that defies the laws of economic gravity.

The macroeconomic context makes this situation even more precarious. The IMF forecasts only 2% growth for the United States in 2026. In a recent note, the Swiss private bank J. Safra Sarasin estimated that a “strong acceleration in earnings per share seems unlikely.” How can we reconcile a stagnating economy with a stock market that anticipates exponential growth?

The question is no longer whether AI will change the world. It will. The question is whether current valuations rest on foundations solid enough to avoid a collapse.

The most likely scenario is perhaps not an exact repeat of 2000, where the entire sector evaporated. It might be a “brutal re-evaluation,” to use the IMF’s term. A crash that would not kill AI, any more than the bursting of the dot-com bubble killed the internet.

On the contrary, that burst purged the market. It eliminated non-viable companies (Pets.com) and allowed the true giants (Amazon, Google, which survived the crash) to emerge and build the digital economy of the next twenty years.

History could repeat itself. A severe correction seems inevitable to bring valuations back to rational levels, aligned with real profitability rather than fantasy. This correction will have victims: the startups without business models, the overly speculative projects, and the retail investors who arrived last.

But it will also solidify the position of the true leaders, those who, like Microsoft or Nvidia, have real revenues and indispensable technology. The AI bubble may burst, but the AI revolution is just beginning. The challenge, for investors and for society, will be to survive the inevitable shock that will separate the euphoria from the reality.

Ion Traps vs. Superconducting – Which Is the Better Quantum Technology?

More and more people are talking about Quantum Computing, whether in the media or in the investment world where everyone fears one thing: missing out on the Next Big Thing.

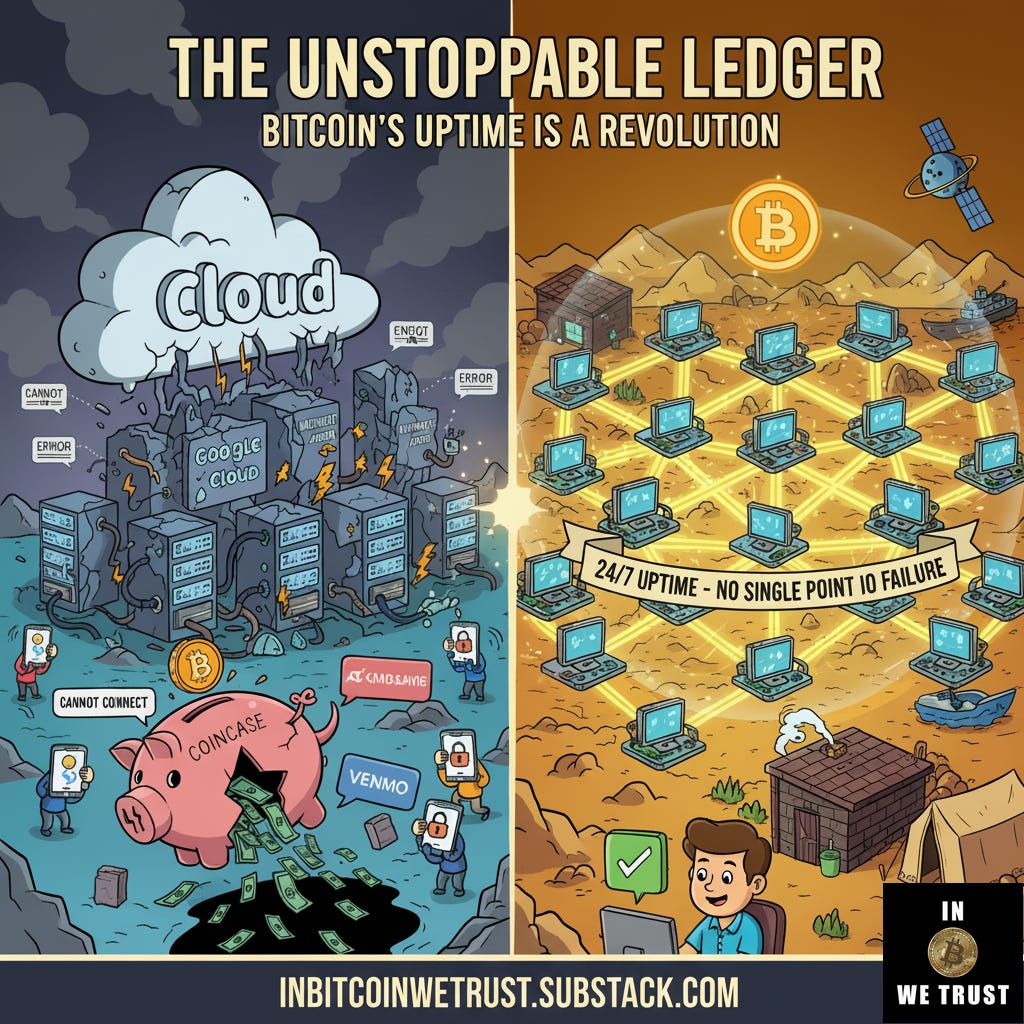

The Unstoppable Ledger: Why Bitcoin’s Uptime is a Revolution.

A single failure in Amazon Web Services brought part of the modern financial world to its knees yesterday. Meanwhile, the Bitcoin network didn’t even notice.

The Quantum Mirage: Are We Betting Billions on the Wrong Computing Revolution?

For decades, we've been told a story about the future. It’s a story of ultimate computational power, of problems once deemed unsolvable succumbing to the bizarre and wonderful logic of the quantum realm. Quantum computing, we are promised, will revolutionize medicine, create new materials, break an entire generation of cryptography, and reshape our worl…

Wow, the mention of the S&P 500's concentration with the tech titans really struck a chord; do you think this current level of market consolidation around a few key players makes the AI bubble, if it is one, fundamentally different or perhaps even more dangerouse than the dot-com bust?