The Silicon Throne: The Unsettling Secret of the Two Clients Holding Nvidia in Their Grip.

For investors, employees, and the entire tech ecosystem, the question is not if one of the pillars of Nvidia's throne will one day be tested, but when.

At the top of the world, where the air is thin and the numbers are dizzying, Nvidia reigns as the undisputed master. Having become the most valuable company on the planet, the semiconductor titan embodies the raw power of the artificial intelligence revolution. Its quarterly revenues, which defy the laws of financial gravity, and its stratospheric market capitalization paint the picture of an impregnable fortress, the philosopher-king of the AI era. Yet, scratching beneath the gleaming veneer of this monumental success, official documents reveal a far more precarious reality: Nvidia’s throne, as majestic as it may be, rests on a dangerously small number of pillars.

A recent filing with the Securities and Exchange Commission (SEC), the U.S. market regulator, has cast a harsh light on the structure of this dominance. Behind record revenues of $46.7 billion for the second fiscal quarter of 2026—a spectacular 56% year-over-year increase—lies a dependence that is both profound and troubling. Nearly 40% of this colossal revenue comes from just two clients. Two mysterious entities, designated by the clinical pseudonyms “Customer A” and “Customer B,” have injected more than $18 billion into Nvidia's coffers in the space of three months.

This extreme concentration, far from being a mere accounting detail, is the Achilles’ heel of this tech colossus. It is the uncomfortable secret that tempers the surrounding euphoria: Nvidia’s phenomenal growth is not the result of a myriad of diversified clients, but the work of a handful of titanic buyers whose loyalty is as crucial as it is potentially volatile.

The Real Trojan Horse: How America's Debt Machine Is Secretly Fueling the Bitcoin Revolution.

It’s a bottom-up, emergent phenomenon. It’s the silent, invisible hand of the market responding to the failures of the fiat system.

Anatomy of a Stratospheric Dependence

To grasp the scale of this phenomenon, one must dissect the cold figures presented in the quarterly report. “Customer A” alone accounts for 23% of Nvidia’s total revenue, representing a staggering quarterly bill of approximately $10.7 billion. “Customer B” is not far behind, making up 16% of revenues, or nearly $7.5 billion. Together, they total 39% of the chip giant's business.

But the concentration doesn’t stop there. The same document reveals the existence of four other major clients, accounting for 14%, 11%, 11%, and 10% of sales, respectively. A simple calculation shows that a mere six companies concentrate an overwhelming majority, nearly 85%, of Nvidia’s revenue. The AI empire, so vast in appearance, is in reality fueled by an extremely exclusive circle of mega-buyers.

This situation is a double-edged sword. On one hand, it testifies to the insatiable and almost infinite demand for Nvidia’s chips, particularly its GPUs (graphics processing units) that power AI-dedicated data centers. The company’s “Data Center” segment alone generated $41.1 billion in the quarter, or 88% of the total, illustrating where the beating heart of the Nvidia reactor lies. On the other hand, this hyper-concentration exposes the company to systemic risk. As Dave Novosel, an analyst at Gimme Credit, points out, “The concentration of revenue among such a small group of customers presents a significant risk.” What would happen if “Customer A” decided to reduce its orders, turn to a competitor, or develop its own solutions? The impact on Nvidia's results would not be a mere scratch; it would be an earthquake.

On the Trail of the Phantom Clients

The identity of these clients is Silicon Valley’s best-kept secret. Nvidia, in its documents, refers to them as “direct customers.” This terminology is crucial. A direct customer is generally not the end-user one might imagine. It is most often an original equipment manufacturer (OEM) like Dell or Hewlett Packard Enterprise, a system integrator like Super Micro Computer, or a massive distributor. These companies buy Nvidia chips in bulk to integrate them into complete servers and complex infrastructures, which they then sell to their own clients.

And who are the clients of these direct customers? The cloud giants, the “hyperscalers.” Names like Microsoft (Azure), Amazon (AWS), Google (Google Cloud), and Meta are considered “indirect customers” of Nvidia. They are the true drivers of demand, the ones building server farms the size of several football fields to train and run their AI models.

Colette Kress, Nvidia’s CFO, provided a key piece of the puzzle herself by confirming that large cloud service providers account for about 50% of the data center segment’s revenue. The connection is crystal clear: “Customer A” and “Customer B” are very likely not Microsoft or Google by name, but rather the gigantic intermediaries that supply them with armies of Nvidia-equipped servers. Companies like Super Micro, which has experienced explosive growth in tandem with Nvidia, or assembly behemoths like Foxconn or Quanta Computer, are the most credible suspects. They are the master builders who transform Nvidia’s silicon into the raw computing power that the cloud titans desperately need.

The Vulnerability at the Heart of Hegemony

This structure creates a complex and potentially dangerous power dynamic. While Nvidia is currently in a position of strength thanks to its overwhelming technological lead with its Hopper and Blackwell architectures, the dependence on such a small number of intermediaries creates several vulnerabilities.

First, negotiation risk. Although current demand exceeds supply, these mega-customers hold colossal bargaining power. They can demand preferential terms, volume discounts, or supply guarantees that could, over time, erode Nvidia’s exceptional profit margins (currently above 70%).

Second, strategic risk. The indirect customers—the cloud giants—do not like being dependent on a single supplier, no matter how good. Microsoft, Google, and Amazon are all investing billions of dollars to develop their own custom AI chips (the Maia, TPU, and Trainium/Inferentia chips, respectively). Their goal is not to replace Nvidia overnight, which would be technically impossible due to Nvidia’s CUDA software ecosystem, but to reduce their dependency for specific tasks and to better control their costs and supply chain in the long run. If one of these players were to achieve a significant breakthrough, it could ask its direct suppliers to reduce their orders of Nvidia chips, causing an immediate shockwave.

Finally, market risk. If one of these direct customers were to face financial, logistical, or geopolitical difficulties, the impact on Nvidia would be direct and massive. Nvidia’s financial health is intrinsically linked to that of a very exclusive club of companies.

A Gilded Cage Protected by the AI Race

However, it would be a mistake to see only the downside. The expert Dave Novosel, while highlighting the risk, also tempers his own analysis: “These customers have abundant cash, generate massive cash flows, and are expected to spend generously on data centers over the next few years.”

Herein lies the paradox of Nvidia’s position. Its dependence is also a reflection of its strength. These are not just any companies; they are the central players in the greatest technological revolution since the advent of the internet. They are engaged in an arms race for AI supremacy, a competition where computing power is the sinews of war. In this frantic race, Nvidia doesn’t just sell chips; it supplies the weapons. For Microsoft or Google, slowing down purchases of Nvidia GPUs would be tantamount to unilateral disarmament in the face of competition.

For now, this dynamic creates a kind of economic “mutually assured destruction.” The customers need Nvidia to remain competitive, and Nvidia needs them to maintain its stratospheric growth. This interdependence has created a gilded cage: Nvidia may be a captive of its largest customers, but these customers are themselves prisoners of the overwhelming need to acquire its cutting-edge technology.

Beyond the Quarter, an Uncertain Horizon

The story of Nvidia is one of absolute technological and commercial triumph. Jensen Huang, its visionary CEO, has positioned his company as the indispensable infrastructure provider of tomorrow’s economy. But the foundations of this empire, as solid as they may seem, rest on a delicate balance. The extreme concentration of its revenue is a warning sign that cannot be ignored.

As long as the AI frenzy continues at this pace and Nvidia’s technological lead remains unchallenged, the risk will remain latent, masked by ever-higher revenues. But markets are cyclical, and the competition, though distant, is organizing with players like AMD and Intel.

Nvidia has built a silicon empire that is redefining our world. But by entrusting the keys to its kingdom to a handful of guardians, it has bet its future on their uninterrupted loyalty and prosperity. For investors, employees, and the entire tech ecosystem, the question is not if one of these pillars will one day be tested, but when—and how well Nvidia’s magnificent edifice will withstand the tremor.

The AI Oracle Has Spoken: Andrew Ng's 5 Predictions That Will Mint the Next Generation of Millionaires.

When Andrew Ng makes a prediction, the world of technology holds its breath. This isn’t just another pundit shouting into the void. This is the man who saw the Deep Learning revolution coming in 2008, long before it became a household term. He anticipated the online education boom

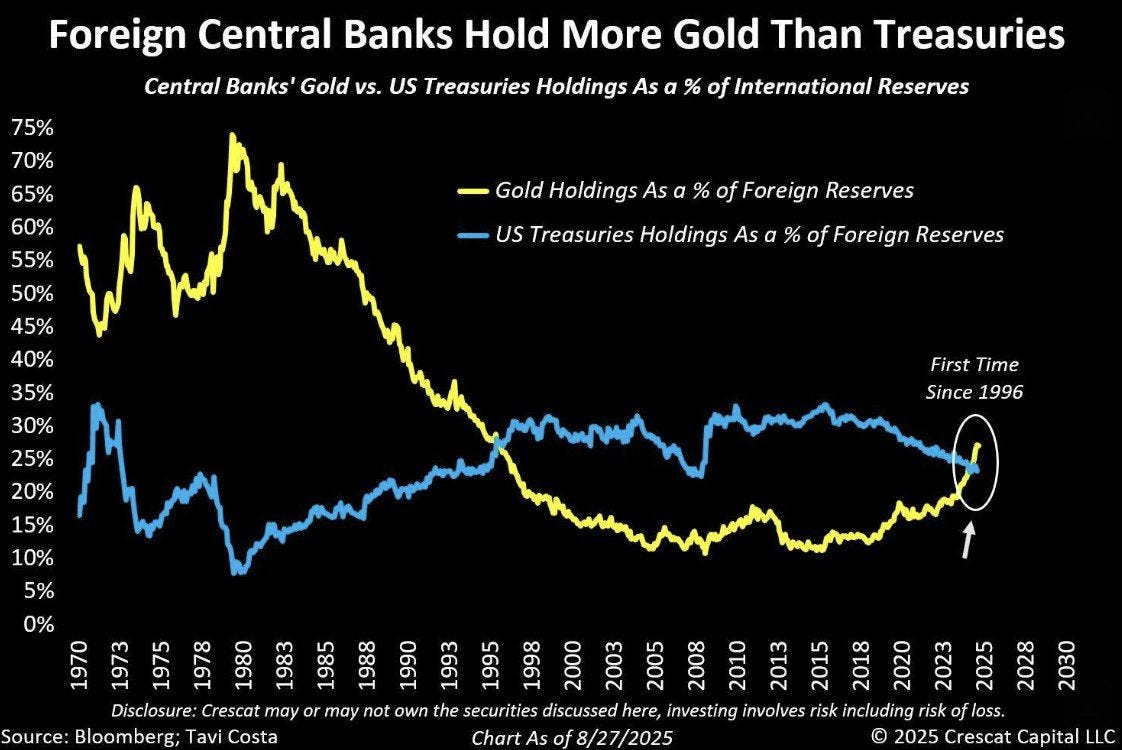

The Silent Reversal: The Chart Signal That Spells the End of a 40-Year Financial Order.

The future of money, the future of savings, lies where it always has: in hard assets that cannot be inflated away by political expediency.

Is OpenAI's $100 Billion Valuation Built on Sand?

The noise was deafening. The promise, almost messianic. In the grand theater of Silicon Valley, where every announcement must be an earthquake, Sam Altman, the high priest of OpenAI, brought out the heavy artillery. A single image posted on X: the Death Star, the planet-destroying weapon of the Galactic Empire. The message, in its sublime arrogance, was…

Bitcoin Core Vs. Bitcoin Knots: The Silent Duel of the Code's Guardians.

Their difference lies not in the rules of the game, but in the policy they apply around those rules.

Nvidia and its customers have built a rod for their own backs. They are strapped together, and to a runaway horse that they can’t escape without massive loss.

How many governments are strapped to them as well, I wonder?

This is not a failure-tolerant setup.